CSE Global: Singapore’s Stealth Dividend Machine Powering the Future

Discover why this overlooked SGX stock quietly delivers 5.3% yields while riding the megatrends of smart cities, electrification, and AI.

If you’re like most Singaporean investors, you probably want two things: steady income and exposure to future growth. But finding both in one SGX stock? That’s rare. Enter CSE Global (SGX:544)-a company quietly building the infrastructure that powers our modern world, all while rewarding shareholders with a reliable 5.3% dividend yield.

The Hidden Backbone of Smart Cities

CSE Global isn’t a household name. Yet, its technology is everywhere. The company designs and maintains the critical systems that keep cities running smoothly. From emergency networks that clear the way for ambulances, to AI-powered controls that keep oil rigs safe, and even the brains behind Singapore’s solar farms and power grids-CSE is the silent partner in our daily lives.

Imagine the city as a living organism. CSE Global is the nervous system, connecting and controlling everything from traffic lights to energy flows. Their projects are long-term, often stretching over several years, which means predictable revenue and stable cash flow.

Financials: Growth, Stability, and Strong Dividends

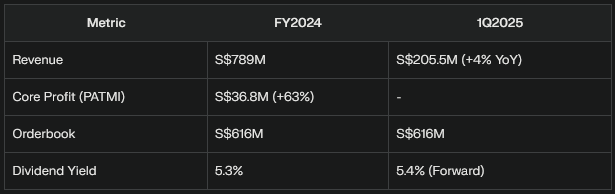

Let’s look at the numbers. CSE Global’s financials tell a story of both resilience and smart growth. In 2024, the company posted S$789 million in revenue, with a core profit of S$36.8 million-a massive 63% jump from the previous year. The orderbook stands at S$616 million, with nearly 70% tied to multi-year projects.

Here’s a quick snapshot:

This growth isn’t just a flash in the pan. CSE’s shift toward high-margin automation and communications projects is paying off. Even as their electrification segment saw a temporary dip in orders, other divisions picked up the slack, keeping the company on a solid upward trajectory.

Riding Three Unstoppable Megatrends

What makes CSE Global so compelling right now? The company sits at the crossroads of three megatrends shaping Singapore and the world:

Urbanisation:

By 2030, Singapore plans to double its solar capacity, expand rail networks, and install hundreds of smart building systems. CSE’s technology is essential for making these plans a reality.

Electrification:

The global push toward green energy is real. CSE recently secured a S$13.1 million contract for chemical injection systems in the U.S. and is supplying power solutions for data centers across Asia-Pacific.

Artificial Intelligence:

CSE’s automation systems now feature AI that predicts grid failures days in advance, slashes energy use in factories, and automates inventory for industrial clients.

Risks: What Investors Need to Know

No stock is without risk. For CSE Global, currency swings matter because 60% of revenue comes from the U.S. dollar. Project delays, especially in Australia, have been a challenge in the past. And while competition is fierce, CSE has responded by acquiring niche specialists like Chicago Communications, which closed in April 2025.

Here’s a summary of the main risks and how the company manages them:

Four Smart Moves for Singapore Investors

If you’re considering CSE Global for your portfolio, here are some practical steps:

Check CPF/SRS Eligibility:

CSE is approved for CPF Investment Scheme, so you can use your retirement funds if it fits your risk profile.Stagger Your Buys:

With the share price at S$0.45, consider buying in tranches. For example, buy a portion now, another if the price dips, and the rest after the next earnings report in August.Watch for Catalysts:

Keep an eye on U.S. infrastructure news, as 40% of CSE’s revenue comes from North America. Also, look out for their next dividend announcement in August.Balance Your Portfolio:

CSE pairs well with S-REITs for income and tech ETFs for growth, helping you build a resilient, future-proof portfolio.

Why CSE Global Deserves a Spot in Your Portfolio

CSE Global isn’t a flashy stock, but it’s a classic “get-rich-slowly” play. The company pays out S$0.024 per share annually, translating to a 5.3% yield-well above most local banks and even many REITs. At 11 times earnings, it’s attractively valued compared to larger peers like ST Engineering.

What sets CSE apart is its ability to grow through smart acquisitions. The recent Chicago Communications deal, closed in April, is expected to boost both earnings and market presence in the U.S. This disciplined approach means you’re not just buying a dividend, but also a pipeline of future growth.