Singapore Bonds Deliver Stunning 6.4% Returns While Global Markets Struggle – Here's Why This Could Be Just the Beginning

Singapore government bonds have quietly become one of 2025's most impressive investment stories, delivering a remarkable 6.4% return in the first half of the year while outperforming 22 major......

Singapore government bonds have quietly become one of 2025's most impressive investment stories, delivering a remarkable 6.4% return in the first half of the year while outperforming 22 major developed market peers. This isn't just a lucky streak – it's the result of a perfect storm of favorable conditions that could continue driving exceptional performance for Singaporean investors who understand the underlying dynamics.

The Numbers Tell a Compelling Story

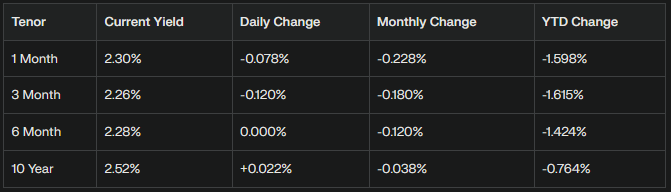

Let me break down exactly what's happening in Singapore's bond market right now. The 10-year Singapore Government Securities (SGS) yield has dropped dramatically to 2.52% as of May 21, 2025, marking a 0.764% decline year-to-date. This creates a massive spread below comparable US Treasuries – a gap that represents a statistical anomaly signaling just how attractive Singapore bonds have become.

[Table 1: Singapore Government Securities Current Yield Snapshot]

This table shows the consistent downward trend across all tenors, with shorter-term rates experiencing more dramatic declines than longer-term bonds, indicating strong demand across the yield curve.

The yield compression has been relentless throughout 2025, with Treasury bill auctions showing particularly strong performance. The six-month T-bill cut-off yield fell to just 2.00% in the June 19 auction – the lowest level year-to-date and the seventh consecutive decline since March 26.

Three Pillars Supporting Singapore's Bond Rally

Pillar 1: Exceptionally Controlled Inflation Environment

Singapore's inflation dynamics remain remarkably supportive for bond investors. The controlled inflation environment gives MAS extraordinary flexibility to maintain accommodative monetary conditions without triggering price pressures, creating an ideal backdrop for bond performance.

Pillar 2: Strategic Supply Scarcity and Strong Auction Demand

Here's where Singapore's approach becomes particularly clever. The government's unique fiscal structure means it doesn't rely on bond issuance to fund expenditures, providing MAS with exceptional flexibility to calibrate supply based on market conditions.

[Table 2: Recent Treasury Bill Auction Performance Trends]

This table demonstrates the persistent downward pressure on yields in shorter-term securities, with six-month bills showing particularly strong performance while one-year bills reflect broader global yield pressures.

Pillar 3: Singapore Savings Bond Success Story

The Singapore Savings Bond program has become a cornerstone of the government's debt management strategy, offering retail investors attractive, flexible investment options while providing stable funding.

[Table 3: Singapore Savings Bond Yield Evolution (2025)]

This table shows the declining trend in SSB yields throughout 2025, reflecting the broader bond market rally while still offering attractive returns for retail investors with full government backing.

Why This Rally Has Staying Power

The current outperformance isn't just a temporary phenomenon. Several structural factors suggest Singapore bonds could continue delivering strong risk-adjusted returns:

Fundamental Supply-Demand Imbalance: The combination of measured government supply and strong institutional demand creates a structural bid for SGS bonds. The recent parliamentary approval to raise the government's issuance limit to S$1.515 trillion from S$1.065 trillion provides flexibility while maintaining disciplined supply management.

Safe Haven Premium: Singapore's AAA credit rating from all major agencies makes it one of only six countries globally with this distinction. The government's practice of investing bond proceeds in reserves rather than spending them provides an additional layer of security that's rare among developed markets.

Yield Curve Positioning: Trading Economics forecasts suggest further room for yield compression, with the 10-year SGS yield expected to trade at 2.49% by the end of Q3 2025 and 2.42% in 12 months. This implies potential for additional capital appreciation beyond the already impressive 6.4% first-half performance.

Investment Implications: Should You Buy Singapore Bonds?

For Conservative Investors: Strong Buy

The combination of government backing, attractive yields, and potential for capital appreciation makes Singapore bonds compelling for capital preservation strategies. The 6.4% first-half return demonstrates the upside potential while maintaining principal protection.

For Income-Focused Investors: Buy

Current yields around 2.52% for 10-year SGS offer real returns when adjusted for Singapore's low inflation environment. The step-up structure in SSBs provides additional income growth over time.

For Tactical Allocators: Buy with Strategic Timing

The persistent yield compression trend across all tenors suggests this trade has more room to run, particularly given structural factors supporting Singapore bonds.

Specific Investment Vehicles to Consider

Singapore Savings Bonds (SSB): The July 2025 issue (GX25070Z) offers compelling value with a 10-year average return of 2.49%, starting at 2.06% in the first year. With full government backing and penalty-free early withdrawal, SSBs provide accessible exposure for retail investors up to the $200,000 limit.

Direct SGS Investment: For larger allocations, direct investment in SGS bonds through primary auctions or secondary markets offers higher yields and duration exposure. The recent trend of declining auction yields suggests positioning sooner rather than later may be advantageous.

Treasury Bills for Short-Term Positioning: Six-month T-bills currently yielding 2.00% provide attractive short-term returns while maintaining flexibility for longer-term positioning as market conditions evolve.

Risk Considerations and Strategic Positioning

While the outlook remains positive, investors should consider duration risk, potential mean reversion in yield spreads, and liquidity constraints in Singapore's smaller bond market compared to major developed markets.

For Singaporean investors, maximizing SSB allocation toward the $200,000 limit while considering longer-duration exposure for potential capital appreciation represents a balanced approach to capturing this structural opportunity.

The Bottom Line: A Structural Opportunity

Singapore's bond market is experiencing a convergence of favorable factors that appear structural rather than cyclical. The 6.4% first-half performance reflects sound fiscal management in an increasingly uncertain global environment, with forecasts suggesting further yield compression potential and structural factors supporting continued outperformance.

Key Takeaways for Investors:

Singapore bonds delivered 6.4% returns in H1 2025, outperforming developed market peers

Current yields across all tenors show persistent downward pressure

SSB program offers retail investors attractive, flexible government-backed returns

Treasury bill auctions demonstrate strong demand and declining yields

Strategic supply management creates persistent scarcity premium