When Indonesia's Unicorn Dreams Turned into a $300 Million Nightmare: Critical Lessons Every Singaporean Investor Must Learn

The spectacular collapse of eFishery – Indonesia's first aquaculture unicorn – isn't just another startup failure story.

The spectacular collapse of eFishery – Indonesia's first aquaculture unicorn – isn't just another startup failure story. It's a masterclass in how systematic fraud can destroy investor confidence across an entire region, and why Singaporean investors need to fundamentally reassess their approach to Southeast Asian growth investments.

The Anatomy of a $1.4 Billion Deception

eFishery's fraud wasn't a momentary lapse in judgment – it was a calculated, seven-year deception that began in 2018 when the company faced near-bankruptcy. The scandal erupted in late 2024 when co-founders CEO Gibran Huzaifah and Chief Product Officer Chrisna Aditya were suspended following a whistleblower report that exposed systematic financial manipulation.

In April 2025, Gibran Huzaifah publicly admitted to manipulating eFishery's financial reports since 2018 to attract investors and "survive" a cash crunch. The company had been maintaining dual accounting systems – one accurate internal set and another inflated version for external stakeholders including investors, banks, and auditors.

The numbers tell a devastating story. For the nine months ending September 2024, eFishery claimed $752 million in revenue when actual revenue was only $157 million – a staggering 4.8x inflation. The company reported a $16 million profit while actually losing $35.4 million. The company even inflated operational metrics, reporting 400,000 fish-feeding devices in use instead of the actual 24,000 units.

This systematic manipulation helped eFishery secure funding from prestigious investors including SoftBank Vision Fund 2, Temasek, Sequoia Capital, Northstar Group, and Abu Dhabi's 42XFund, ultimately achieving a $1.4 billion valuation in May 2023. According to FTI Consulting's investigation, investors may recover less than 10 cents for every dollar invested, with total investor losses potentially exceeding $300 million from the $415 million raised across five funding rounds.

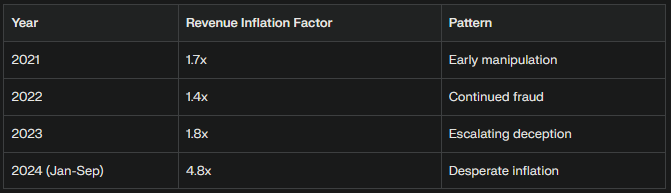

Table 1: eFishery's Systematic Revenue Inflation Pattern (2021-2024)

Table 2: eFishery's Reported vs. Actual Financial Performance (Jan-Sep 2024)

The Ripple Effect: How One Fraud Shattered Regional Confidence

The eFishery scandal has created what Justin Hall of Golden Gate Ventures calls a "chilling effect" that could last 12 months or longer. This isn't hyperbole – it's already materializing in concrete ways that directly impact Singaporean investors.

Indonesia's startup funding plummeted 43.5% year-over-year in H1 2025, dropping to just $161.3 million across 34 deals – the lowest level in recent years. This represents a dramatic decline from $285.4 million across 36 deals in H1 2024. The broader Southeast Asian startup ecosystem also saw funding decline 24% to $2 billion in H1 2025, though late-stage deals surged 140% to $1.4 billion, primarily driven by mega-deals in Singapore.

For Singaporean investors, this creates both challenges and opportunities. The immediate challenge is increased scrutiny and longer due diligence processes for Indonesian investments. However, the opportunity lies in potentially acquiring quality assets at discounted valuations as the market overcorrects.

Critical Investment Implications for Singaporean Portfolios

Immediate Actions Required:

Portfolio Review: Conduct immediate forensic analysis of any Indonesian startup investments, particularly those in growth stages

Due Diligence Enhancement: Implement bank statement verification and independent financial audits for all Southeast Asian investments

Governance Assessment: Evaluate board composition and internal controls of existing investments

Strategic Positioning:

Defensive: Reduce exposure to Indonesian growth-stage startups until governance standards improve

Opportunistic: Prepare capital for quality investments at discounted valuations as market sentiment recovers

The Regulatory Vacuum That Enabled Systematic Fraud

The eFishery scandal exposed critical gaps in Indonesia's regulatory framework that every Singaporean investor must understand. Unlike Singapore's robust oversight mechanisms, Indonesia's startup ecosystem operates with minimal regulatory scrutiny.

Indonesia's Financial Services Authority (OJK) has been strengthening its oversight capabilities, particularly with the transition of crypto-asset supervision from Bappebti to OJK in January 2025. However, traditional startups like eFishery still operate outside comprehensive regulatory frameworks. The government has introduced new business licensing regulations (PP 28/2025) that took effect on June 5, 2025, implementing risk-based business licensing with clearer processes and digital integration.

Comparative Regulatory Framework Analysis

Sector-Specific Impact: Where the Damage Runs Deepest

The fraud's impact varies significantly across sectors, with agritech bearing the brunt of investor skepticism. Despite receiving $22.6 million across seven deals in H1 2025, the sector now faces heightened scrutiny due to direct association with eFishery.

Most Affected Sectors:

Agritech: Direct association with eFishery creates guilt by association

Growth-stage startups: Increased due diligence requirements and longer funding cycles

B2B platforms: Similar business models face enhanced scrutiny

Resilient Sectors:

New Retail: Led Indonesian funding with $44.4 million in H1 2025, showing continued investor confidence in consumer-facing businesses

Early-stage investments: Continue to dominate funding, indicating resilient appetite for high-potential early bets

The New Investment Paradigm: What Singaporean Investors Must Do Now

The eFishery scandal marks a watershed moment requiring fundamental changes in investment approach. Here's your actionable framework:

Enhanced Due Diligence Protocol

Financial Verification:

Bank Statement Analysis: Require 24-month bank statements with third-party verification

Revenue Recognition Audit: Implement independent verification of revenue sources and timing

Customer Validation: Direct contact with claimed major customers to verify relationships

Dual Book Detection: Specifically look for signs of multiple accounting systems

Governance Assessment:

Board Composition: Mandate independent directors and audit committees

Management Background: Comprehensive background checks on all C-level executives

Internal Controls: Evaluate segregation of duties and financial reporting processes

Auditor Quality: Verify the reputation and track record of external auditors

Portfolio Construction Strategy

Geographic Diversification:

Limit Indonesian exposure to 15-20% of Southeast Asian allocation

Increase Singapore and Malaysia weightings for stability

Consider Vietnam and Thailand for growth with better governance

Stage Allocation:

Reduce growth-stage Indonesian investments by 30-40%

Increase early-stage allocation where fraud risk is lower

Focus on revenue-generating companies with verified financials

Long-Term Implications: The Road to Recovery

The path forward requires systemic changes that will reshape the Indonesian startup landscape. The government's recent regulatory reforms, including the new business licensing regulation (PP 28/2025) and enhanced OJK oversight capabilities, signal positive momentum.

However, recovery will be gradual. Experts predict a 12-18 month period of heightened scrutiny before investor confidence returns to pre-scandal levels. This timeline creates a strategic opportunity for patient Singaporean investors willing to conduct thorough due diligence.

Recovery Timeline Projections

Short-term (6-12 months):

Continued funding decline and increased due diligence requirements

Market consolidation through M&A activities

Enhanced regulatory oversight implementation

Medium-term (12-24 months):

Gradual return of investor confidence

Emergence of governance-focused investment criteria

Potential attractive valuations for quality assets

Long-term (24+ months):

Stronger, more transparent startup ecosystem

Improved regulatory framework

Sustainable growth based on genuine fundamentals

Your Investment Action Plan

Immediate Steps (Next 30 Days):

Audit all Indonesian startup investments for governance red flags

Implement enhanced due diligence protocols for future investments

Reduce Indonesian allocation if above recommended thresholds

Strategic Positioning (3-6 Months):

Build relationships with Indonesian startups demonstrating strong governance

Prepare capital for opportunistic investments as valuations adjust

Diversify Southeast Asian exposure across multiple markets

Long-term Strategy (12+ Months):

Gradually increase Indonesian exposure as governance standards improve

Focus on post-scandal startups with built-in transparency measures

Leverage improved regulatory environment for sustainable returns

The eFishery scandal isn't just Indonesia's problem – it's a wake-up call for all Southeast Asian investors. Those who learn from this crisis and adapt their strategies accordingly will be best positioned to capitalize on the region's long-term growth potential while avoiding similar pitfalls.

The key lesson is clear: in an era where growth at any cost has given way to sustainable, transparent business building, governance isn't optional – it's the foundation of every successful investment strategy. The companies that emerge stronger from this crisis will be those that prioritize transparency, implement robust internal controls, and build sustainable business models based on genuine value creation rather than inflated metrics.