Where Are the Best Dividend Yields in Singapore REITs? Sectors and Picks for 2025

Singapore REITs are trading at a discount, with yields at multi-year highs. But which sectors and names actually deserve your money in 2025? Let’s break down the data, sector by sector, so you can in

Singapore REITs (S-REITs) have had a tough few years. Rising interest rates, global uncertainty, and sector-specific shocks have all weighed on prices and payouts. But with 2025 shaping up to be a turning point, is it finally time to hunt for yield in S-REITs again?

Let’s dive in, sector by sector, with updated numbers, simple charts, and practical takeaways for your portfolio.

The Big Picture: S-REITs in 2025

After a rough 2024, S-REITs are showing signs of stabilizing. Share prices are down about 12% from their highs, and the sector now trades at a forward price-to-book ratio of just 0.80x-well below the 8-year average of 0.98x. The average trailing twelve-month yield sits at 6.3%, with many names offering even higher payouts.

Interest rates in Singapore have started to ease, and the US Federal Reserve is expected to cut rates later this year. Lower rates mean lower borrowing costs for REITs, which should eventually boost their distribution per unit (DPU). Analysts expect DPU growth of about 1% in 2025, with the real impact showing up in the second half of the year as old, expensive debt gets refinanced at lower rates.

S-REITs Sector Snapshot (May 2025)

Sector Breakdown: Where’s the Value Now?

Let’s break down the four main S-REIT sectors: Industrial (Logistics/Data Centres), Retail, Office, and Hospitality. We’ll look at the numbers, trends, and top picks in each.

1. Industrial: Logistics and Data Centres Lead the Way

Industrial REITs-especially those focused on logistics and data centres-have been the clear winners as Singapore’s economy pivots toward tech and e-commerce.

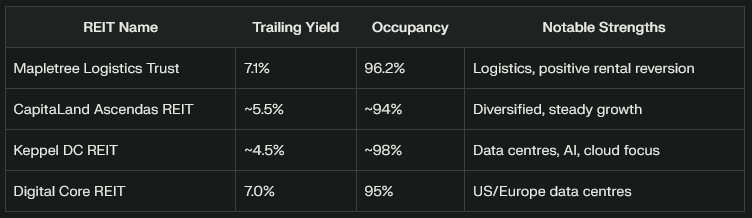

Mapletree Logistics Trust (MLT): Trailing yield of 7.1%, with portfolio occupancy at 96.2% and positive rental reversions of 5.1% in Q1 2025. MLT is actively recycling assets, selling older properties at a premium and buying new ones in Vietnam and Malaysia.

CapitaLand Ascendas REIT (CLAR): Owns 229 properties across Singapore and developed markets. Gross revenue rose 2.9% in 2024, and rental reversions are expected to stay in the mid-single digits this year.

Data Centre REITs: Keppel DC REIT and Digital Core REIT are riding the AI and cloud wave. Keppel DC REIT’s latest acquisition of two hyperscale data centres in Singapore boosted its portfolio value by 36% and is expected to grow income available for distribution by 8.1%. Digital Core REIT offers a trailing yield of 7%.

Industrial & Data Centre REIT Yields (2025)

Takeaway:

Logistics and data centre REITs are best placed for growth, with strong demand and positive rent reversions. Look for REITs with high occupancy, strong sponsors, and a focus on new economy assets.

2. Retail: Suburban Malls Shine

Singapore’s retail REITs are bouncing back as shoppers return to malls. Suburban malls, in particular, have shown resilience.

Frasers Centrepoint Trust (FCT): Trailing yield close to 6%. FCT’s portfolio is nearly fully occupied (99.5%) and focuses on heartland malls with steady footfall. Recent upgrades and acquisitions have strengthened its position.

CapitaLand Integrated Commercial Trust (CICT): Singapore’s largest retail/commercial REIT. DPU has been stable, and rental reversions are positive. CICT’s malls are seeing strong shopper traffic, especially in suburban areas.

Retail REIT Occupancy and Yield (2025)

Takeaway:

Retail REITs with a focus on suburban malls are well-positioned for stable returns. Look for high occupancy rates and strong tenant mixes.

3. Office: Cautious Optimism

Office REITs are at a crossroads. Singapore office rents are at multi-year highs, but economic headwinds could soften demand.

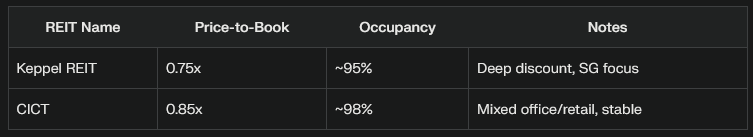

CapitaLand Integrated Commercial Trust (CICT) and Keppel REIT: Both trade at discounts to book value and have strong sponsors. Office demand is picking up, but new supply is muted for the next 3-5 years.

Overseas Exposure: Be cautious. US office REITs are struggling with low occupancy due to hybrid work trends, and currency risk is a concern as the Singapore dollar remains strong.

Office REIT Discount to Book (2025)

Takeaway:

Singapore-focused office REITs are attractively priced, but watch for economic slowdowns that could impact rents. Avoid US office REITs until occupancy improves.

4. Hospitality: Headwinds Ahead

The hospitality sector faces challenges. RevPAR (revenue per available room) has flattened, and new supply is increasing competition. Major events that boosted demand in 2024 are absent this year.

Frasers Hospitality Trust: Was the top performer in March 2025, but this year is likely to be one of stabilization, not growth.

Acrophyte Hospitality Trust: Offers a high yield (12.16%) but comes with higher risk due to leverage and sector headwinds.

Takeaway:

Hospitality REITs are best approached with caution. Rising costs and increased competition may cap growth in 2025.

Practical Takeaways for S-REIT Investors

1. Focus on Quality and Resilience

Prioritize REITs with strong sponsors, high occupancy, and a focus on Singapore assets. Sectors like logistics, data centres, and suburban retail are set to outperform.

2. Don’t Chase Yield Blindly

High yields can signal higher risk. Check gearing ratios and asset quality before investing. Diversify across sectors to manage risk.

3. Watch the Interest Rate Cycle

The biggest boost to S-REITs will come as old debt is refinanced at lower rates in late 2025 and 2026. REITs with a higher proportion of floating-rate debt will benefit first.

4. Use Price-to-Book as a Guide

S-REITs trading below book value (P/B < 1.0) offer a margin of safety, especially if their assets are in Singapore.

5. Avoid Overexposed Overseas REITs

Currency risk and weak recovery in overseas markets (especially US offices) are real concerns.

Action Steps for Your Portfolio

Shortlist 2-3 REITs from logistics, data centre, and suburban retail sectors.

Check their latest gearing ratios and occupancy rates.

Aim for a blended portfolio yield of 6% or higher.

Revisit your REITs quarterly as interest rates and sector conditions evolve.

Final Thoughts

S-REITs are offering some of the best yields in years, but not all sectors are equal. By focusing on resilient sectors and quality names, you can build a portfolio that delivers steady income and stands up to market volatility. Stay curious, stay invested-and as always, keep it simple and smart.

All figures updated as of May 2025.