Who Gets Your CPF Money When You're Gone?

Don't leave your hard-earned savings to chance. A simple step today ensures your CPF goes exactly where you want it tomorrow.*

Have you ever wondered what happens to your CPF savings when you're no longer around? It's a topic many of us avoid, but understanding it is crucial for protecting our loved ones. As a Singaporean, your CPF likely represents one of your largest assets - with the average member having over S$127,000 in their account, and those between 45-60 years old averaging more than S$200,000. Yet many don't realize that without proper planning, this money could end up distributed in ways they never intended.

Let me walk you through exactly what happens to your CPF when you pass away and the simple steps you can take now to ensure your money goes where you want it to.

The Most Important Fact About Your CPF After Death

Here's something that surprises many Singaporeans: your CPF savings don't automatically form part of your estate. This means your will doesn't cover your CPF money. Your CPF savings follow a completely different set of rules for distribution after death.

There are two main scenarios for what happens to your CPF when you pass away, and they depend on one crucial decision: whether you've made a CPF nomination.

Scenario 1: You've Made a CPF Nomination

If you've made a valid CPF nomination, the CPF Board will distribute your savings directly to your nominees according to the percentages you specified. The process is relatively quick - the CPF Board typically contacts nominees within 10 working days after being notified of your death. Your nominees can then apply to withdraw the funds.

What's great about making a nomination is that you have complete freedom to choose who gets your money. You can nominate any person or organization, and there's no limit to the number of nominees you can appoint. Want to leave some money to your favorite charity? You can do that. Want to split it among family members in specific proportions? That's possible too.

What Your CPF Nomination Covers

The assets not covered by your nomination are handled separately according to your will or intestacy laws.

Scenario 2: You Haven't Made a CPF Nomination

This is where things get more complicated and potentially problematic. Without a nomination, your CPF savings will be forwarded to the Public Trustee's Office (PTO) for distribution according to Singapore's intestacy laws. For non-Muslims, this means following the Intestate Succession Act 1967, while for Muslims, it's the Administration of Muslim Law Act 1966.

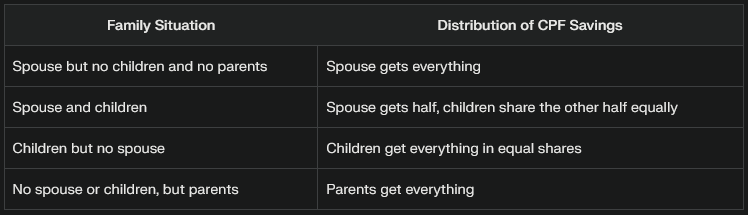

Distribution Rules for Non-Muslims Under the Intestate Succession Act

Three Major Drawbacks of Not Making a Nomination

Time Delays: It takes time, potentially up to 6 months, for the PTO to identify eligible beneficiaries. During this period, your loved ones might face financial difficulties.

Administrative Fees: The PTO charges fees that are deducted from your CPF savings before distribution. These fees reduce the amount your family ultimately receives.

Distribution Might Not Align With Your Wishes: Maybe you wanted to provide more for a child with special needs, or perhaps you wanted to include a long-term partner who isn't legally your spouse. Without a nomination, these wishes won't be honored.

Making a CPF Nomination is Simple

The good news is that making a CPF nomination is free and straightforward. You must be at least 16 years old and of sound mind. You can now make your nomination online anytime, anywhere, which makes the process much more convenient.

How to Make Your CPF Nomination

1. Online Method

Prepare your SingPass details

Have your nominees' NRIC details ready

Arrange for two witnesses (who must have SingPass)

Log into CPF's my cpf Online Services

Click on "My Requests" → "CPF Nomination" → "Make a CPF Nomination"

Submit your nomination

Your witnesses will receive notifications to confirm your nomination within 7 days

2. In-Person Method

Make an appointment to visit a CPF Service Centre

Bring your NRIC/Passport

Complete the nomination form at the service centre

Customer Service Executives can act as your witnesses

When to Review Your CPF Nomination

It's crucial to review your nomination regularly, especially after major life events:

Marriage: Automatically revokes any existing CPF nomination

Childbirth: Ensure your child is included as a beneficiary

Divorce: Does NOT automatically revoke your nomination

Death of a Nominee: Update your nomination to reflect new beneficiaries

Special Situations to Consider

Nominees Under 18: If one of your nominees is under 18, the CPF Board will send their share to the PTO to be held in trust until they reach adulthood.

Nominee Passes Away: If a nominee passes away after you, but before receiving the money, their share becomes part of their estate.

Special Needs Dependents: There's a Special Needs Savings Scheme (SNSS) nomination option that allows you to nominate any of your children with special needs to receive your CPF monies on a monthly basis.

CPF Nomination Statistics in Singapore

The importance of making a CPF nomination is underscored by recent statistics from the CPF Board:

About 4 in 5 CPF members who passed away in 2024 had made a CPF nomination

Older members are more likely to have made a nomination - about 86% of members aged 65 and above have made a CPF nomination compared to only 36% among those aged 16 to 64

Of the members aged 16 to 64 who haven't made a nomination, the majority are 44 years old and below

Unlike for age, there are no sharp differentiations in nomination rates among the different races

Latest CPF Updates for 2025

While focusing on your nomination, it's worth noting some key CPF changes for 2025:

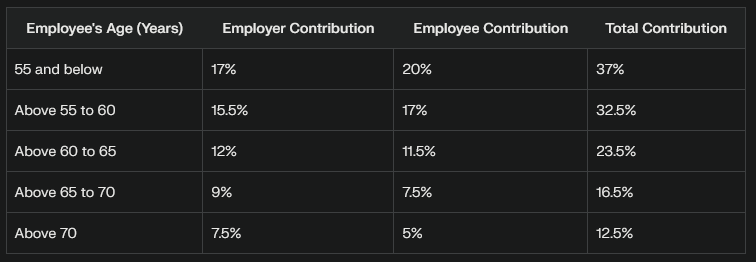

New Contribution Rates (Effective January 2025)

CPF Interest Rates (2025)

Remember that you can earn up to 5% on your Special Account with the extra 1% interest on the first $60,000 of your combined balances (with up to $20,000 from the OA).

Take Action Today

Think about this: You've worked hard your whole life to build up your CPF savings. Doesn't it make sense to spend a few minutes ensuring those savings go exactly where you want them to after you're gone?

Making a CPF nomination is one of the simplest yet most important financial planning steps you can take. It ensures your money goes directly to your chosen beneficiaries, avoids unnecessary delays and fees, and gives you peace of mind knowing your wishes will be respected.

When was the last time you checked your CPF nomination status? If you've never made one or if you've experienced major life changes since making one, today is the perfect day to take action.

Key Takeaways

Check Your Nomination Status: Log into your CPF account to see if you have a valid nomination in place.

Make a Nomination if You Haven't: Use the online system or visit a CPF Service Centre to make your nomination.

Review After Life Events: Remember to review your nomination after marriage, having children, or divorce.

Consider Special Needs: If you have dependents with special needs, explore the SNSS nomination option.

Inform Your Nominees: Let your nominees know about your nomination so they're aware of what to do when the time comes.

Don't leave your CPF distribution to chance. Take control of your financial legacy by making or updating your CPF nomination today. Your loved ones will thank you for it.

This article was last updated on May 12, 2025, with the latest CPF nomination statistics and regulations.