Singapore Bond ETFs: Your One-Stop Ticket to Passive Income and Diversification

With T-bill yields cooling off, Singapore bond ETFs are stepping up as a smart, low-hassle way to earn steady income. Here’s how to pick the right one for your portfolio.

What Are Bond ETFs, and Why Should You Care?

Imagine a bond ETF as a basket filled with many different eggs, where each egg is a bond from a different government or company. Instead of putting all your money into one egg and hoping it doesn’t crack, you get a whole basket. If one egg breaks, you still have plenty left. That’s the power of diversification.

Bond ETFs let you invest in a wide range of bonds-government, corporate, or even foreign-without needing a large sum of money. In Singapore, these ETFs are listed on the SGX and can be bought and sold just like stocks.

With T-bill yields dipping from their recent highs, more investors are looking at bond ETFs for steady, passive income. As of May 2025, Singapore-listed bond ETFs manage over S$3 billion in assets and offer dividend yields between 2.31% and 7.59%.

The Good and the Bad: Pros and Cons of Bond ETFs

Advantages

Diversification: You own a mix of bonds with different issuers and maturity dates, which reduces your risk.

Easy Access: Build a fixed-income portfolio with just one trade. No need for complex strategies or big capital.

Regular Income: Many bond ETFs pay dividends quarterly or semi-annually, giving you a predictable stream of income.

Liquidity: You can buy or sell these ETFs anytime during market hours, unlike individual bonds, which can be harder to trade.

Low Cost: Expense ratios are generally low, often between 0.20% and 0.50%.

Disadvantages

No Maturity Date: Unlike individual bonds, bond ETFs don’t mature. There’s no set date when you’ll get your original investment back.

Interest Rate Risk: When interest rates rise, bond prices fall. If you sell your ETF during a rate hike, you might take a loss.

Credit Risk: Higher yields often come with lower credit ratings, which means more risk of default.

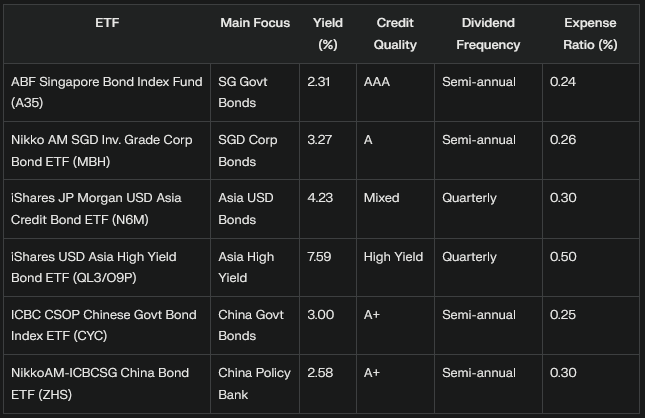

Top Singapore Bond ETFs in 2025: Quick Comparison

Here’s a handy table summarizing the key features of the main Singapore-listed bond ETFs. All data is current as of May 2025.

How to Choose the Right Bond ETF for You

1. What’s the Credit Rating?

AAA-rated funds like ABF Singapore Bond Index Fund and Xtrackers II Singapore Government Bond UCITS ETF focus on Singapore government bonds. These are very safe, but offer lower yields.

A-rated or A+ funds (like Nikko AM SGD Investment Grade Corporate Bond ETF and China-focused ETFs) offer a balance between safety and yield.

High yield funds (like iShares USD Asia High Yield Bond ETF) pay more but carry higher risk.

2. What’s the Dividend Yield and Frequency?

If you want the highest yield, the iShares USD Asia High Yield Bond ETF offers up to 7.59%, but with higher risk.

For regular payouts, look for ETFs with quarterly distributions, like the iShares Asia Credit Bond Index ETF and iShares Asia High Yield Bond Index ETF.

3. What’s the Expense Ratio?

Lower is better. Most Singapore bond ETFs charge between 0.20% and 0.50% per year.

4. What’s the Track Record?

Check the 1-year return. For example, ABF Singapore Bond Index Fund delivered +5.78% over the past year, while the iShares USD Asia High Yield Bond ETF was down -2.25%.

Practical Examples: Which ETF Fits Which Investor?

Safety-First Investor:

Choose ABF Singapore Bond Index Fund or Xtrackers II Singapore Government Bond UCITS ETF for AAA-rated, government-backed safety and stable income.Yield Hunter:

Go for iShares USD Asia High Yield Bond ETF for the highest yield, but be ready for more price swings and credit risk.China Exposure Seeker:

Pick ICBC CSOP Chinese Government Bond Index ETF or NikkoAM-ICBCSG China Bond ETF for direct access to Chinese government and policy bank bonds.Quarterly Income Lover:

iShares JP Morgan USD Asia Credit Bond ETF and iShares USD Asia High Yield Bond ETF pay dividends quarterly, which can help with regular cash flow.

Table: Key Features of Major Singapore Bond ETFs

Actionable Takeaways

Match Your Risk Appetite: If you want safety, stick to government bond ETFs. For higher returns, consider corporate or high-yield bond ETFs, but accept the extra risk.

Check Dividend Frequency: If you need regular income, choose funds that pay quarterly.

Watch the Expense Ratio: Lower fees mean more money in your pocket over time.

Diversify: Don’t put all your eggs in one basket-mix government and corporate bond ETFs for better balance.

Stay Updated: Yields and returns change. Review your bond ETF choices at least once a year.

Bond ETFs are like the Swiss Army knife of the investment world-versatile, easy to use, and suitable for both new and seasoned investors. Whether you’re after safety, yield, or exposure to new markets, there’s a Singapore bond ETF that fits your needs. Happy investing, and may your portfolio grow as steady as the Singapore skyline!